Let’s talk about a fundamental finance topic that all of us intuitively appreciate but overlook when it matters the most: DEBT and its role in investing. We will also explore how Indian investors are currently placed in terms of leverage in their portfolios, given the buoyancy of capital markets. Today’s newsletter is inspired by the recent writings of Howard Marks (Impact of Debt) and Morgan Housel (How I Think About Debt) on the subject. Let’s begin with some essential basics about debt.

Important basis related to DEBT

1. DEBT is a Performance Magnifier

DEBT, often referred to as LEVERAGE, helps us buy more assets using borrowed money. Therefore, whenever we win, we win more by investing lesser amount of own money. This is a straightforward rule, all of us understand very well. What we often forget (especially in good times) is that there is also a flip side to this. When we try to buy more assets using borrowed money, we also lose more when we lose. So the bottom line is, DEBT is a performance magnifier that plays its role irrespective of whether you make a profit or a loss.

2. DEBT Reduces Endurance

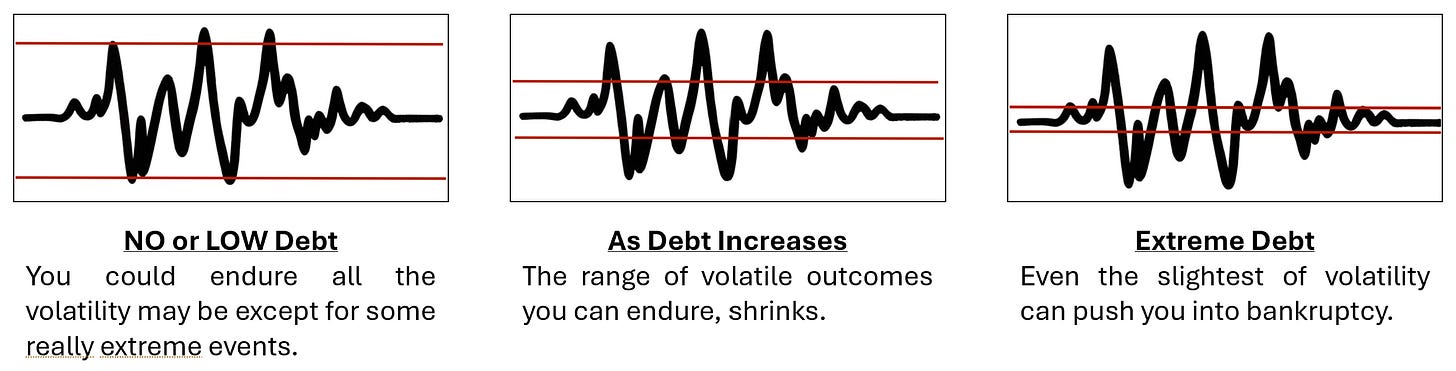

Another important and often overlooked characteristic regarding debt is that it reduces ENDURANCE. Morgan Housel puts it very nicely when he says, the more you borrow, the narrower the range of volatile outcomes you can endure. Pictorial summary below.

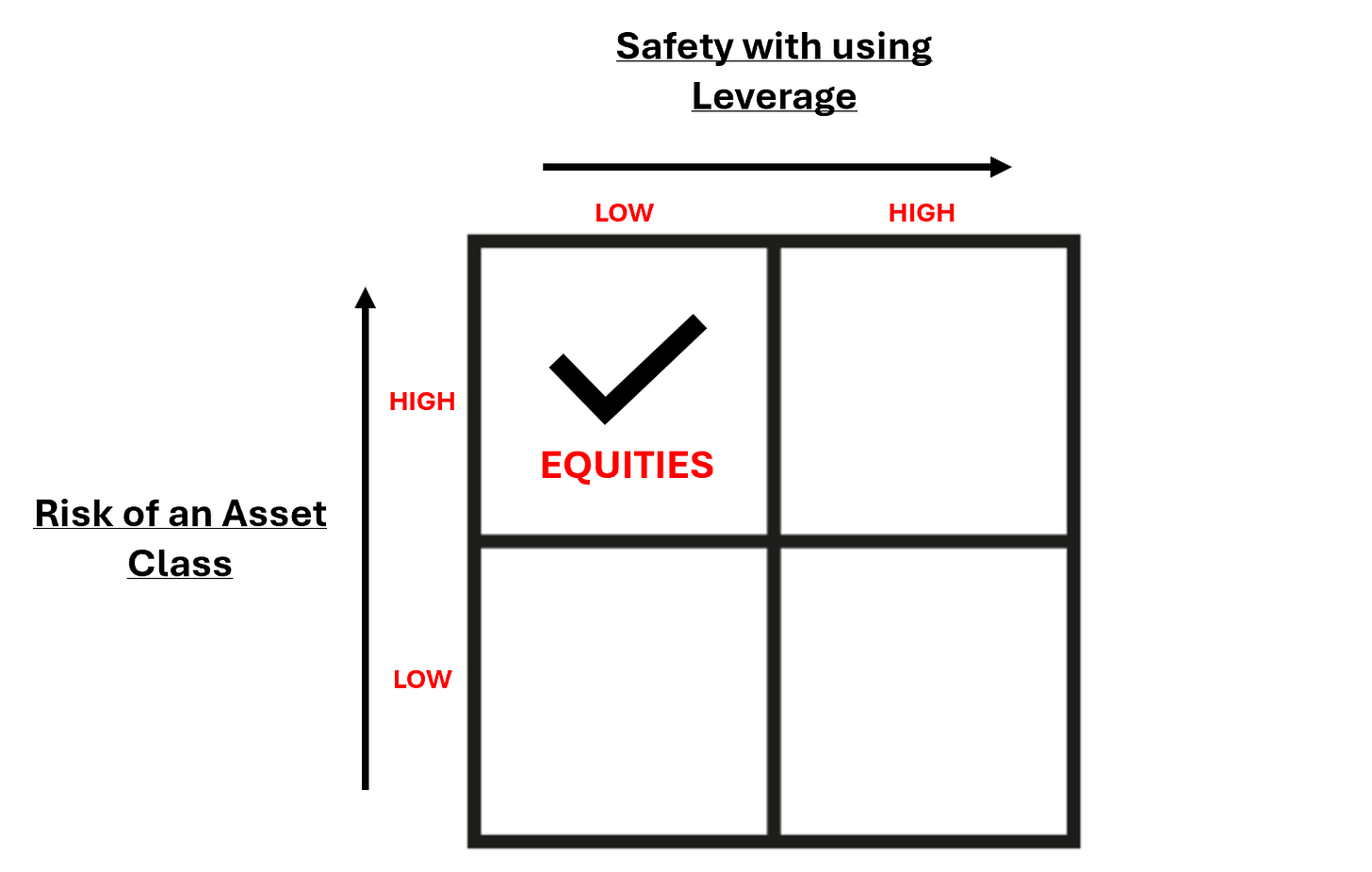

3. DEBT should be viewed in the context of the RISK involved in the Asset Class you plan to Invest in Veteran Investor, Howard Marks shares a very simple but extremely handy mental model in his memo to think about the usage of debt. He says, The more stable the assets, the more leverage it’s safe to use. Riskier assets, less leverage. You very well know which quadrant EQUITIES fall into. The Golden Grid.

4. DEBT is not Always Bad

Before you take an extreme view, let me tell you that debt in itself is not bad. It is the reckless usage that makes it so. If an investor uses debt within his means and looks to optimize, debt could help. The problem starts when an investor starts looking to maximize performance using leverage. This is when a levered investor becomes vulnerable to volatility and may face the risk of ruin. Again, Howard Marks puts it concisely and extremely effectively by saying, VOLATILITY + LEVERAGE = DYNAMITE.

The folly of Working with Averages

Now that we know some of the most important characteristics of debt, let’s try to understand how an investor usually thinks about taking leverage in his investing endeavours.

If you are thinking that investors don’t give enough thought to risk management and take leverage mindlessly, let me tell you that you may NOT be thinking on the right lines. All investors understand risk management and most of them take AVERAGE historical volatility into account to consider the amount of leverage they should take.

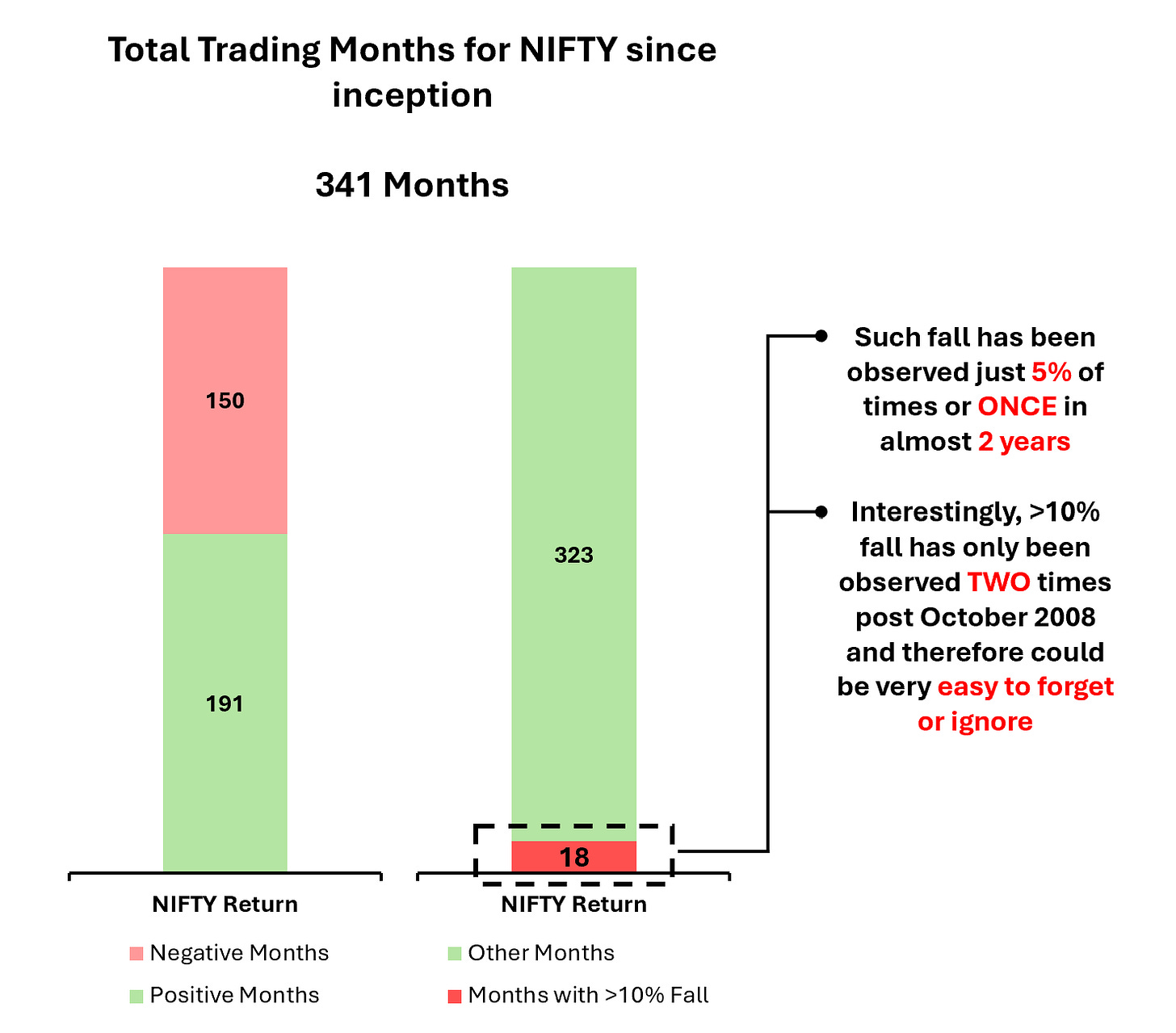

However, in this process of working with averages, there is one important investing rule investors miss to focus on. That is, long term investing requires you to survive the WORST, which unfortunately doesn’t get captured very well while calculating averages. It’s the OUTLIER EVENTS that generally wipe levered investors off, and the worst part about these events is that they OCCUR INFREQUENTLY (therefore, investors forget these events and more so during great times) and are IMPOSSIBLE TO PREDICT. The graph shown below will give you a good sense of this.

Looking at the above NIFTY Monthly Return chart gives us a great sense of how INFREQUENT these sharp falls can be. Long term investing success depends on your ability to endure such months where the quantum of negative return is a few times that of median and unfortunately, AVERAGE misses out on communicating this fact.

This is why levered investors fail to stay alive during such extreme events despite appreciating the concept of risk management. This is because, during such events even if losses aren’t permanent, a downward fluctuation can bring risk of ruin if a portfolio is highly leveraged. Some probable reasons for such occurrence could be (a) the lenders cutting off credit, (b) investors getting frightened into withdrawing their equity, or (c) the violation of regulatory or contractual standards could also trigger forced selling.

What’s Happening in India?

In the exhilarating highs of a booming market, investors often amplify their stakes using debt, and this time is no exception. Since 2020, the NIFTY has soared by ~81%, while small-cap and mid-cap stocks have skyrocketed by an astounding 175-210%. This surge is nothing short of spectacular.

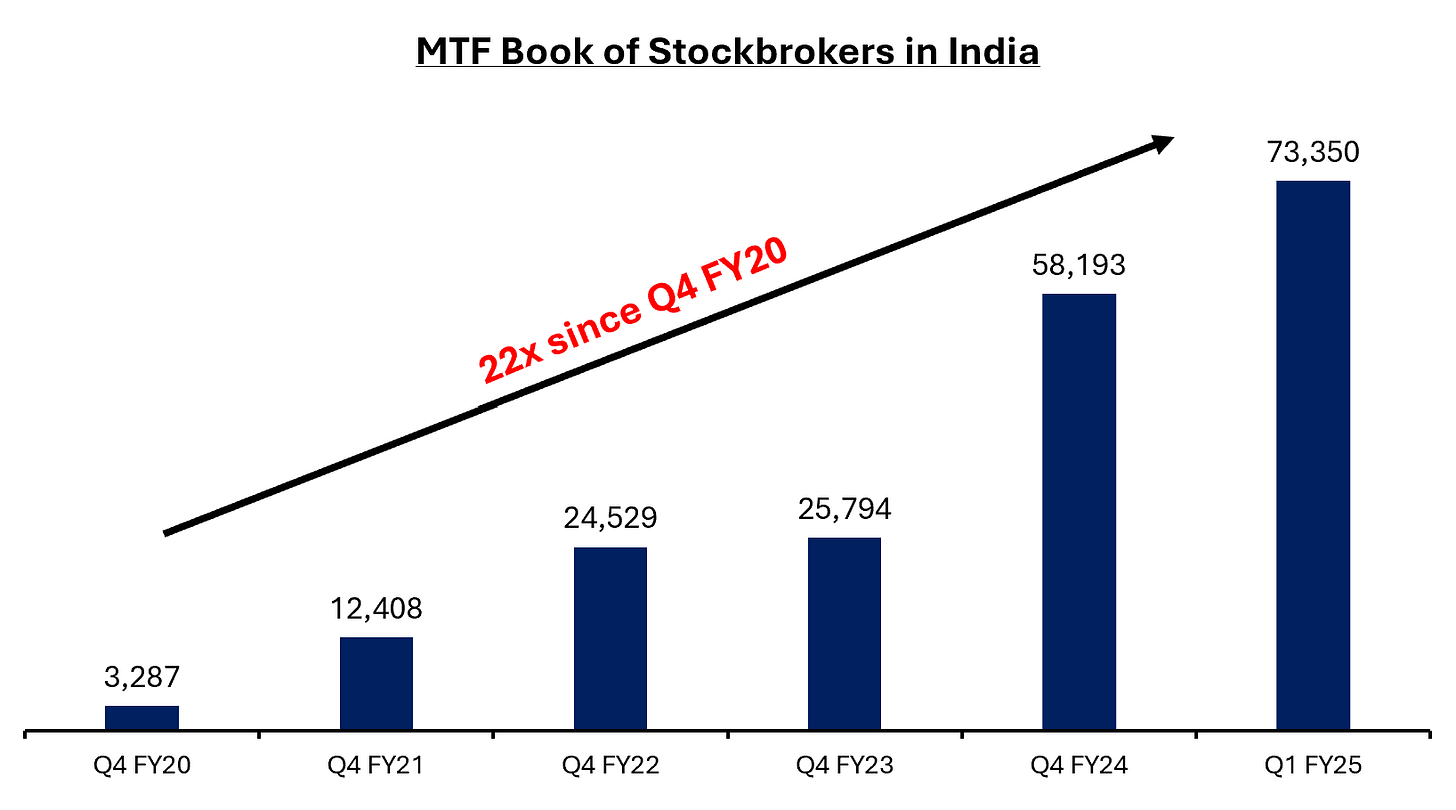

Reflecting this, Indian investors have significantly leveraged their portfolios. The total Margin Trading Facility (MTF) book of brokers in India has exploded, increasing by an astonishing 22x since Q4 FY20. Brokers remain bullish on this lucrative business, and for good reason—the returns they generate from this venture far exceed the NIFTY's compound annual growth rate since its inception, all with virtually zero risk.

The above trend clearly illustrates why brokers are eagerly extending credit to investors, but it also warns that investors who have overextend their leverage are headed for a potentially nightmarish scenario. Now, what will happen? Only time will tell.

Are you an Optimizer or a Maximizer?

Having explored all the above insights, we arrive at the pivotal question: Are you an Optimizer or a Maximizer? This isn't a tough question to answer for yourself; you know your risk tolerance and the extent of leverage in your portfolio relative to your capacity.

If, like me, you've avoided leverage entirely, you can continue focusing on nurturing your portfolio. However, if you're attempting to fully exploit the market's current uptrend through leverage, beware—this path could lead to financial ruin. It's crucial to reassess your capital structure, not just your portfolio positions.

Remember, in the long-term investing journey, you have to survive to thrive. You must endure the lowest points, which may not appear frequently and are easy to overlook, but inevitably occur in every investor's career.

Happy Investing !!!

Disclaimer: These insights are based on our observations and interpretations, which might not be complete or accurate. Bastion Research and its associates do not have any stake in companies mentioned. This newsletter is for educational purposes only and is not intended to provide any kind of investment advice. Please conduct your own research and consult your financial advisor before making any investment decisions based on the information shared in this newsletter.